A COMMITMENT TO CLARITY & SUPPORT THROUGHOUT YOUR PROBATE PROCESS

Overwhelmed by Executor Responsibilities?

Expert Pennsylvania Probate Support to Guide You Every Step

If you've been named as an executor or personal representative in Pennsylvania, you're facing one of life's most significant legal responsibilities. Between court deadlines, property decisions, family dynamics, and the fear of making costly mistakes, it's normal to feel overwhelmed—especially while grieving.

You don't have to navigate this alone. PA Probate Help provides specialized executor services throughout Montgomery, Philadelphia, Bucks, Delaware, and Chester counties. Led by Certified Probate Real Estate Specialist Joe Thomas, we guide you through every aspect of estate administration with clarity, compassion, and decades of Pennsylvania probate expertise.

You're Not Alone: Common Executor Challenges We Solve

Being an executor means you're legally responsible for settling an entire estate - managing assets, paying debts, filing taxes, and distributing inheritances - all under strict court oversight and often during one of the most emotionally difficult times of your life.

Legal Uncertainty: Confusion about Pennsylvania probate laws and requirements

Time Pressure: Court deadlines while balancing work and family obligations

Financial Liability: Fear of personal liability for executor mistakes

Paperwork Overload: Complex court filings and documentation requirements

Property Decisions: Uncertainty about selling or distributing real estate

Family Conflicts: Navigating disagreements among beneficiaries

Emotional Stress: Handling a loved one's affairs while grieving

These concerns are valid. Pennsylvania executors face real legal liability for failing to perform duties properly. That's exactly why

PA Probate Help exists - to provide expert guidance that helps you fulfill your responsibilities with confidence and peace of mind.

Understanding Your Role as Pennsylvania Executor

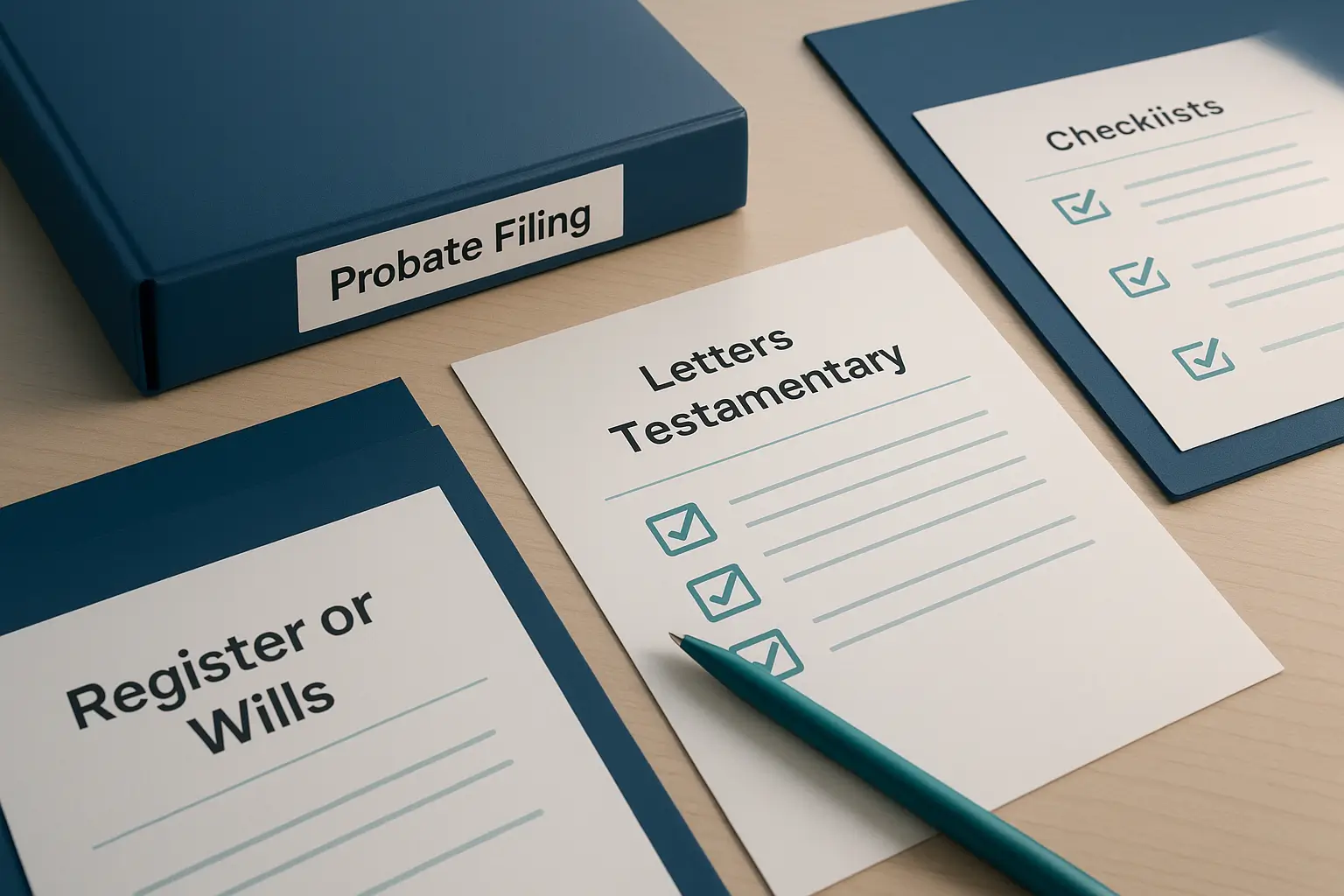

Who Handles Probate?

When someone dies with a will in Pennsylvania, the executor named in that document manages the estate under supervision of the county's Register of Wills and Orphans' Court. Without a will, the court appoints an administrator to handle settlement according to state intestacy laws.

Can There Be Multiple Executors?

Yes, Pennsylvania allows co-executors. While this distributes the workload, it requires both parties to agree on every decision, which can cause delays. Clear communication and defined responsibilities are essential for co-executors.

Out-of-State Executors

Pennsylvania doesn't strictly require executors to be state residents, but local presence makes the process significantly easier. Out-of-state executors face challenges with court appearances, property management, and coordinating local professionals.

Your Primary Responsibilities as Pennsylvania Personal Representative/Executor

Pennsylvania executors must handle numerous complex tasks. Here's what you're responsible for:

Estate Asset Management

Identifying and inventorying all estate assets including real estate, bank accounts, investments, vehicles, personal property, and business interests

Determining which assets fall under probate versus those passing directly to beneficiaries (life insurance, retirement accounts with named beneficiaries, jointly-owned property with survivorship rights)

Appraising or valuing estate assets to establish fair market value for tax purposes and equitable distribution

Real estate often requires professional appraisal, especially if property will be sold

Financial Administration

Opening an estate checking account to manage estate funds separately from personal finances (required by Pennsylvania law)

Receiving payments due to the estate including final paychecks, tax refunds, insurance proceeds, and outstanding debts owed to the deceased

Paying outstanding debts and valid claims after proper investigation and court approval

Managing ongoing expenses including mortgage payments, property taxes, insurance, utilities, and maintenance costs until assets are distributed

Legal & Tax Obligations

Filing required court documents with the Register of Wills, including petition for probate, inventory, and accounting of all transactions

Giving proper notice to creditors through published advertisements and direct notification as required by Pennsylvania law, then managing the claims process according to statutory timeframes

Handling Pennsylvania inheritance tax returns: According to 20 Pa.C.S. § 3392, inheritance tax returns must be filed within nine months of death. Pennsylvania offers a 5% discount for early payment within three months. Tax rates are 4.5% for direct descendants, 12% for siblings, and 15% for other heirs. [Source: PA Department of Revenue]

Filing federal estate tax returns if the estate exceeds federal threshold amounts (currently $13.61 million for 2024)

Filing the deceased's final income tax returns and any estate income tax returns required during administration

Understanding executor authority: Under 20 Pa.C.S. § 3353, executors receive Letters Testamentary from the Register of Wills, which grant legal authority to act on behalf of the estate. This authority is subject to court oversight and beneficiary rights.

Meeting all statutory deadlines to avoid penalties, interest, and potential personal liability for late filings

Property Distribution

Determining who receives what from the estate according to the will's terms or Pennsylvania intestacy laws

Managing real estate sales when property must be sold to pay debts, taxes, or distribute proceeds among beneficiaries

Distributing assets to beneficiaries only after all debts, taxes, and expenses are paid and you receive court approval

Administrative Tasks

Notifying Social Security, banks, and government agencies of the death to stop benefits and close accounts

Discontinuing utilities and services or transferring them as appropriate

Securing and maintaining property throughout the probate process

Keeping detailed records of every transaction and decision for court review and beneficiary transparency

How PA Probate Help Guides Pennsylvania Executors

You don't need to figure this out alone. Our specialized executor services provide the guidance, resources, and professional network you need to fulfill your responsibilities efficiently and correctly.

Initial Consultation & Assessment

We begin with a comprehensive review of your situation, including the estate's assets, will provisions, family dynamics, and immediate concerns. We help you understand the complete scope of your responsibilities and create a prioritized action plan.

Pennsylvania Probate Process Guidance

We walk you through Pennsylvania's specific probate requirements including filing with the Register of Wills, meeting court deadlines, understanding inheritance tax obligations, and navigating Orphans' Court procedures. Our expertise covers all five counties we serve.

Real Estate & Property Management

As a Certified Probate Real Estate Specialist, Joe Thomas provides expert guidance on handling inherited real estate - determining whether to sell or distribute, obtaining valuations, preparing properties for sale, navigating court approvals, and maximizing value while minimizing costs.

Professional Network Coordination

We've built relationships with trusted Pennsylvania probate attorneys, accountants, appraisers, and estate sale specialists. We help you find the right professionals and coordinate their efforts efficiently so you're not managing multiple vendors alone.

Decision-Making Support

Throughout the process, you'll face difficult decisions with significant financial & legal implications. We provide objective guidance based on decades of experience, helping you weigh options, understand consequences & make informed choices that fulfill your fiduciary duties.

Ongoing Problem-Solving

Unexpected issues always arise during probate. Whether discovering unknown assets, handling creditor claims, dealing with property damage, or managing beneficiary objections, we provide practical solutions based on what actually works in Pennsylvania probate cases.

Common Personal Representative/Executor Mistakes We Help You Avoid

Pennsylvania executors face personal liability for failing to perform duties properly. Here are critical mistakes we help you avoid:

Selling Assets Without Proper Authority

We begin with a comprehensive review of your situation, including the estate's assets, will provisions, family dynamics, and immediate concerns. We help you understand the complete scope of your responsibilities and create a prioritized action plan.

Mismanaging Estate Assets

Executors have a fiduciary duty to preserve and protect estate value. We help you make prudent decisions about investments, property maintenance, and asset management.

Failing to Collect Money Due

From final paychecks to insurance proceeds, estates often have receivables that must be collected. We help you identify and pursue all amounts owed.

Overpaying or Underpaying Creditors

Pennsylvania has specific rules about creditor claims priority and payment. We guide you through the proper process to protect the estate and beneficiaries.

Missing Tax Deadlines

Late Pennsylvania inheritance tax filings result in penalties and interest. We help you meet all tax deadlines and take advantage of early payment discounts.

Poor Record-Keeping

Pennsylvania courts require detailed accounting of all executor actions. We help you maintain proper documentation to satisfy court requirements and protect yourself from beneficiary challenges.

Pennsylvania Probate Timeline: What to Expect

Average Timeline for Estate Administration in Pennsylvania

MONTH 0-1:

INITIAL FILING

File will with Register of Wills

Obtain Letters Testamentary

Notify beneficiaries and creditors

Gather death certificates and documentation

Average Duration: 2-4 weeks (Can take longer if documents are incomplete)

MONTH 1-3:

ASSET INVENTORY & EARLY TAX PAYMENT

Identify and value all estate assets

Open estate checking account

Appraise real estate and valuables

Pay estimated inheritance tax for 5% discount (Deadline: 3 months from death)

Average Duration: 8-12 weeks

MONTH 3-6:

CLAIMS PERIOD

Creditor claims period (PA law allows up to 1 year from death)

Investigate and pay valid debts

Begin property sales if needed

Continue asset documentation

Average Duration: 12-16 weeks

MONTH 6-9:

TAX FILING & COMPLIANCE

File decedent's final income tax returns

File PA inheritance tax return (Deadline: 9 months from death)

File federal estate tax return (if required)

Obtain tax clearances from PA Dept of Revenue

Average Duration: 8-12 weeks

MONTH 9-12:

FINAL DISTRIBUTION

Prepare final accounting for court

Obtain court approval or beneficiary releases

Distribute remaining assets to beneficiaries

Close estate bank account

File final documentation with Register of Wills

Average Duration: 12-16 weeks

TOTAL AVERAGE TIMELINE SECTION

Simple Estate: 9-12 months

Moderate Estate: 12-18 months

Complex Estate: 18-24+ months

Definition and Duties of the Personal Representative/Executor

Who is legally responsible for handling probate?

When someone dies with a will, the personal representative or executor they name will be responsible for handling probate under the control of the state’s probate court, in most cases.

When there is no will, the court will appoint an administrator who manages the estate and probate based on the state’s probate laws.

In most states, the probate court maintains a great deal of oversight over the executor or administrator’s actions and requires permission to do certain activities like selling property.

Can there be more than one personal representative?

Serving as a personal representative is a major responsibility and requires a great deal of time. It is possible for someone to name more than one person to act as executor of the estate. This can come with downsides as the co-executors must act together and agree on everything. This can be inconvenient and cause delays.

Is it required for the personal representative to live in the decedent’s state?

Each state has its own laws regarding personal representatives. In most states, it isn’t strictly necessary for the executor to live in the decedent’s state but it certainly makes the process easier and faster.

What are the main duties of a personal representative of an estate?

The executor has many responsibilities during probate. The personal representative’s primary duties include:

➡️ Identifying and creating an inventory of the assets of the estate

➡️ Determining which, if any, assets fall under probate

➡️ Receiving any payments due to the estate

➡️ Opening an estate checking account

➡️ Appraising or valuing estate assets

➡️ Determining who will receive what from the estate

➡️ Giving notice to potential creditors

➡️ Investigating claims against the estate

➡️ Paying outstanding debts and claims

➡️ Paying expenses to administer the estate

➡️ Handling paperwork which includes notifying Social Security of the death, court documents, and discontinuing utilities

➡️ Distributing property and assets to beneficiaries

➡️ Filing final taxes

If I am named as the personal representative, do I have to accept?

Being an executor is a major job. If you are named an executor, you do not have to accept. If you agree to serve as the personal representative, you can also resign later if the job is too difficult. The alternate person named in the will can be appointed by the probate court if you refuse the job or the probate court can appoint someone else.

Are personal representatives usually paid?

There is no requirement that the executor be paid, but most receive compensation for the work they do. Personal expenses are always paid and the representative usually receives a fee of around 2% of the estate’s total value. In some states, this is mandated by law. The fee usually gets smaller as the estate’s value grows.

Any funds paid to the executor must be approved by the probate court. In some circumstances, additional fees can be awarded.

What happens if the personal representative fails to perform their legal duties?

One of the reasons many people refuse to be an executor is the legal liability they face. An administrator or executor who does not perform their duties can face personal liability for any damages they cause.

There are many circumstances in which an executor can be liable, such as selling assets without authority, mismanaging assets, failing to collect money due the estate, overpaying creditors, failing to file taxes on time, or distributing assets to the wrong beneficiaries.

Any of these errors (and others) can cause the personal representative to face out-of-pocket costs.

Who can or can't be a personal representative of an estate?

As a general rule, anyone can be an executor if they are over 18. Some states bar felons from serving as executors. There may also be limits on out-of-state personal representatives who may need to be a primary beneficiary or obtain a bond.

If the court needs to appoint a personal representative or an administrator, they typically choose from this list in the following order of priority:

➡️ The person named as the personal representative in the will

➡️ A surviving spouse who is a beneficiary

➡️ Other beneficiaries

➡️ Surviving spouse who is not a beneficiary

➡️ Other heirs

➡️ Someone chosen by a creditor and approved by a probate judge

Why Pennsylvania Executors Choose PA Probate Help

Specialized Probate Expertise

Joe Thomas holds the Certified Probate Real Estate Specialist (CPRES) designation, representing advanced training specifically in probate property transactions and executor support. You're working with someone who understands the unique challenges of estate administration.

Pennsylvania-Focused Experience

We exclusively serve Pennsylvania executors and understand the specific requirements of Montgomery, Philadelphia, Bucks, Delaware, and Chester counties. From local court procedures to PA inheritance tax rules, we know the details that matter.

Comprehensive Support Network

Beyond our direct services, we've built relationships with trusted Pennsylvania probate attorneys, estate accountants, appraisers, cleanout services, and contractors. You gain access to this entire professional network with coordination handled efficiently.

Executor-First Approach

We understand you're managing this responsibility during a difficult time while balancing other life obligations. Our approach prioritizes reducing your stress and time investment while ensuring nothing falls through the cracks.

Transparent Communication

You'll never wonder what's happening with your estate. We provide clear explanations of requirements, realistic timelines, and honest assessments of challenges. Executors appreciate our straightforward communication style.

Problem-Solving Focus

Estate administration rarely goes exactly as planned. Our value shows most clearly when unexpected issues arise. We've seen virtually every probate complication and know practical solutions that work in Pennsylvania courts.

Complete Executor Support: All Services Under One Roof

Most Pennsylvania executors need help with multiple aspects of estate settlement. Rather than coordinating separate professionals, PA Probate Help provides comprehensive support throughout the entire process.

Executor Guidance

Complete probate process support from filing to final distribution. We walk you through every requirement, deadline, and decision.

Inherited Property Sales

Specialized probate real estate services including valuation, preparation, marketing, and sale coordination. Get maximum value with minimum hassle.

Estate Cleanout Coordination

Professional cleanout services for inherited properties. We handle sorting, donations, disposal, and preparing homes for sale or distribution.

Professional Network

Access our trusted network of Pennsylvania probate attorneys, estate accountants, appraisers, and specialists. We coordinate everything.

Executor Service FAQs for Pennsylvania Probate

What are the main duties of a personal representative in Pennsylvania?

A personal representative manages every significant aspect of estate administration — from identifying assets and filing court documents, to collecting payments, paying debts, and distributing property. This role is crucial under Pennsylvania law and carries legal responsibility and deadlines.

Do I have to be a Pennsylvania resident to serve as executor?

No. Pennsylvania allows out-of-state executors, but being local simplifies property management, court filings, and vendor coordination. We help executors from any location handle these tasks efficiently.

What happens during the initial consultation for executor services?

We start with a full review of the estate's assets, will status, family circumstances, and immediate priorities. Then we create a clear action plan based on Pennsylvania probate requirements so you’re never unsure what to do next.

How do you help with Pennsylvania inheritance tax and court filings?

We guide you through Pennsylvania’s tax rules and filing deadlines (like the 9-month inheritance tax return), work with CPAs and accountants, coordinate with the Register of Wills, and help you complete all required paperwork correctly and on time.

What if the estate includes real estate or multiple properties?

As a Certified Probate Real Estate Specialist (CPRES), I manage property valuations, determine whether to sell or distribute real estate, coordinate staging, inspections and listing prep — all aligned with Pennsylvania estate administration and legal requirements.

What common mistakes do executors make and how can we help avoid them?

Executors often face issues like selling assets without legal authority, missing tax deadlines, mishandling creditor claims, or poor record-keeping. With support, you’ll receive checklists, vendor coordination, documentation guidance, and clear guidance to protect yourself and the estate’s value.

Can you coordinate vendors and professionals on my behalf?

Yes. We coordinate with trusted Pennsylvania vendors - attorneys, CPAs, appraisers, clean-out crews, contractors, and real-estate professionals - so you don’t have to vet each one yourself or manage multiple points of contact during a stressful time.

How quickly can I get help if I’ve just been named executor?

You can schedule a consultation immediately. Early involvement is key to avoiding major delays or penalties. We can assess your situation, map out required steps, and help you begin the process confidently.

What is your geographic service area for executor support?

We serve executors across Pennsylvania with special focus on Montgomery, Philadelphia, Bucks, Delaware, and Chester counties. Our local knowledge ensures you meet county-specific requirements efficiently.

Why should I work with your team instead of handling executor tasks alone?

Dealing with probate independently often means extra stress, missing details, or costly delays. Our executor service offers experienced guidance, a proven process, and professional coordination so you can focus on your family while we handle the estate responsibilities.

Joe Thomas

Certified Probate Real Estate Specialist

If you have any questions about the probate process or would like to speak with a Certified Professional Real Estate professional about your specific probate needs, please use the following form to get in touch. We can also be reached directly at (215) 452-9415.

Contact Joe Thomas

IMPORTANT NOTE:

Please be aware that the information on this page is delivered without warranty or guarantee of accuracy. It’s provided to help you learn more and formulate specific questions to discuss with your attorney and/or your Real Estate Professional and/or to help a personal representative, executor or executrix when executing their challenging responsibilities. By accessing this page, you acknowledge that it has been provided for information only and that you are hereby advised that any decisions regarding probate issues should be discussed with an attorney and/or a Real Estate Professional.